Costs of buying property in Italy

• Notary expenses

Notary expenses can vary depending on the notary and notary deed type. Usually notary service cost starts from about 2.000 Eur for regular house acquisition.

• Acquisition taxes

In case of property purchase even if buyer is not resident in Italy he is obliged to pay some taxes. Taxes are lower if the property is purchased as a principal home (in italian “prima casa”). Usually foreigners buy property in Italy as second homes. In case of buying as principal home the buyer must take residence in the new house within next 18 month after the purchase .

The exact amount of taxes to pay is calculated by the notary and must be comunicated by the notary in advance. All taxes are to pay directly to the notary during the deed (in italian "rogito notarile").

The taxes to pay are:

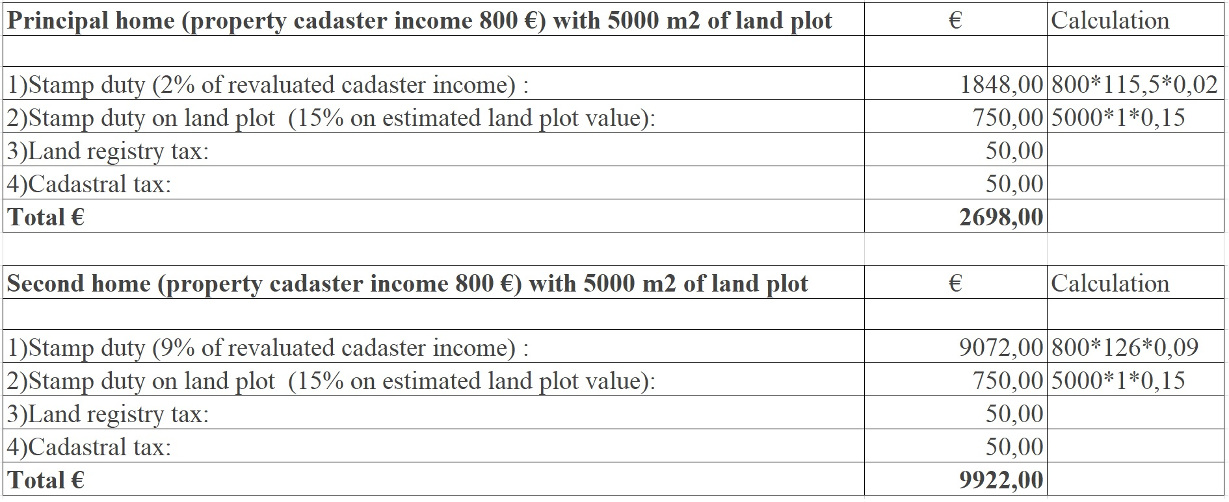

1) Stamp duty (in italian “Imposta di registro"): 9% of cadastral revaluated income of the house and in case of second home and 2% on cadastral revaluated income in case of principal home. Usually the cadastral income is lower than the market price of the property.

2) Stamp duty for land plot (in case of buying a land plot): is calculated as 15 % of estimated land price, which amount is comunicated by the notary and is determined by the most adherent market value (this value can be found on the tables drawn up by the revenue agency). Thist tax amount is the same for principal and second homes

3) Land registry tax (in italian “Imposta ipotecaria”):is fixed amount of 50 €

4) Cadastral tax (in italian “Imposta catastale”): is fixed amount of 50 €

• Estate agency commission

In case of our agency the comission is 3% on the deed amount (vat included) .

• Bank loan expenses (in case of getting a bank loan)

In case of bank loan there are some other expenses to add:

• The expertise of the property (in italian "Perizia"): usually about 300 Eur;

• Bank enquiry costs(in italian "Spese di istruttoria"): variable, can be around 0.5% - 1% of the total loan amount, but it can also be lower or zero;

• Substitute tax (in italian "Imposta sostitutiva"): 0,25 % of loan amount in case of principal home and 2% of loan amount for second home;

• Notary fees for opening a loan. Notary deed is necessary in case of getting bank loan;

• Home insurance policies.

• Expences for notary deed translation in language of buyer (only in case if buyer doesn't speak italian)

Example of acquisition tax calculation:

Please consider this information demonstrative and generic, tax regulations can change or there can be specific cases. Contact us for more information.